Why Self-Fund?

Self-Funding Basics

Self-funding provides the ability to design a custom health benefits plan around specific needs or goals.

Unlike traditional health plans with a fixed premium, self-funding is an arrangement where the employer assumes the financial risk but also the rewards potential of providing healthcare benefits.

Primary Components

There are administrative costs, stop-loss premiums, and any other set fees charged per employee which are referred to as “fixed costs” and are billed monthly based on plan enrollment. The employer also pays the claim costs incurred by the members, which vary from month to month based on plan utilization.

Reimbursements are made if the claims costs exceed the deductible and/or aggregate attachment point as outlined in the policy. The total annual self-funded plan costs are the fixed costs plus the claims expense less any stop-loss reimbursements.

How It Works

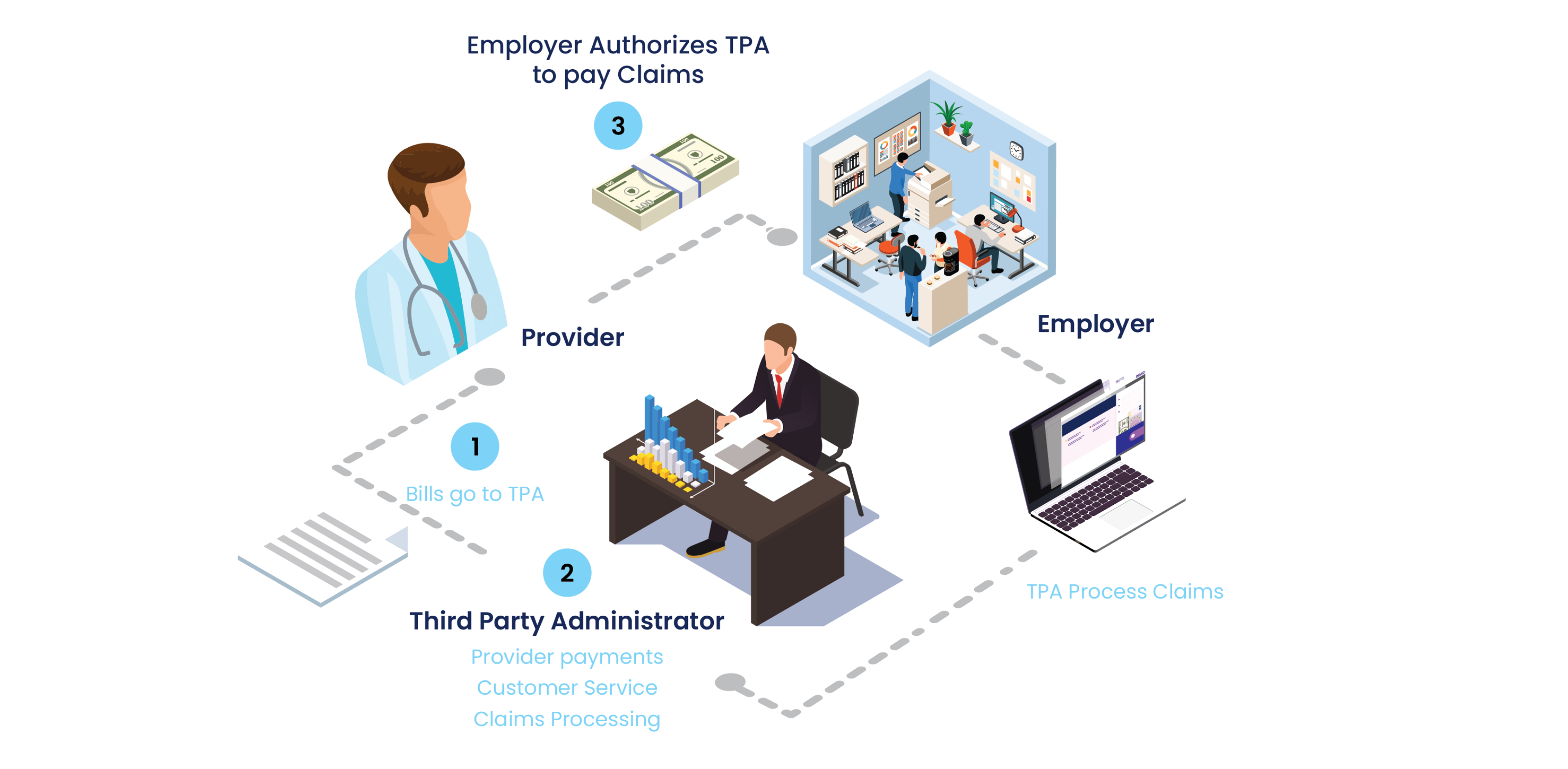

A business that wishes to self-fund will partner with a third-party administrator (TPA) like ACS. The TPA will work with the employer and provide benefits, process claims, and receive robust reporting with insightful data to better manage the risks and future costs of healthcare.

Many employers will also elect to partner with a stop-loss carrier for additional protection against catastrophic claims.

Employer Group Partners with ACS

Provider -> ACS Processes Claims, Pays Providers, Provides Customer Support -> Employer

Fact vs. Fiction

Benefits of Self-Funding

Greater Flexibility

Cost Management

Information Management

Increased Financial Control

Access to Plan Information

Potential for Lower Costs

Self-Funding with ACS

ACS Benefit Services is in the people business. First and foremost, we want to get to know you. We want to learn more about your business, specific wants, and unique needs. This allows us to create a customized health plan with innovation, savings, and support for long-term results.

Want to learn more about self-funded health plans and your options with ACS?

Wes Jones

Vice-President, Sales